reverse sales tax calculator bc

Reverse Sales Tax Formula. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Also a handy tool for business owners sales reps accountants and anyone else who needs to.

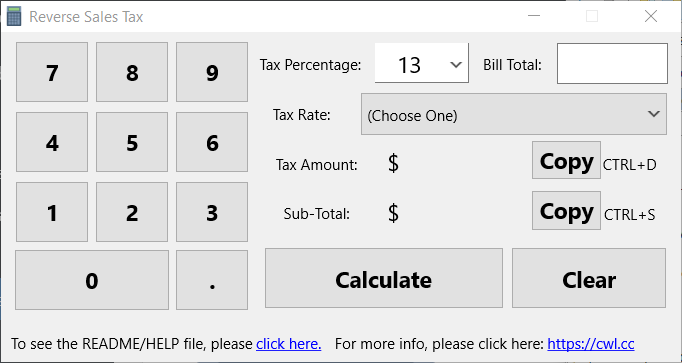

. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. Enter the sales tax percentage. Why A Reverse Sales Tax Calculator is Useful.

BC Revenues from Sales Taxes. Formula for calculating reverse GST and PST in BC. Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax.

Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. I have a product used to sell for 118 which includes value of the product is 100 9 of CGST tax 9 of SGST tax which equals 10099118. Other provinces in Canada do not use the HST and instead use a distinct Goods and Services Tax GST andor Provincial Sales.

Margin of error for HST sales tax. Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all of BCs taxation revenue during the 2019 fiscal year. Great for finding your total cost before a purchase.

The Provincial Sales Tax PST applies only to three provinces in Canada. Where the supply is made learn about the place of supply rules. - calculate taxes and find out the before-tax subtotal of a total reverse calculator.

This calculator include the non-refundable personal tax credit of Basic Personal Amount. The second script is the reverse of the first. Using this reverse tax calculator is extremely simple and easy.

How to Calculate Reverse Sales Tax. New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island. Like income tax calculating sales tax often isnt as simple as X amount of money Y amount of state tax In Texas for example the state imposes a 625 percent sales tax as of 2018.

Province of Sale Select the province where the product buyer is located. The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces. This is greater than revenue from BCs corporate income tax and property tax combined.

Following is the reverse sales tax formula on how to calculate reverse tax. Also a handy tool for business owners sales reps accountants and anyone else who needs to find the before or after tax amount. For example total cost is 118 i need a help for the formula to work back 10099118.

Read reviews compare customer ratings see screenshots and learn more about softwareName. Who the supply is made to to learn. If you want a reverse GST PST calculator BC only just set the calculator above for British Columbia and it will back out the 12 combined tax rate for the amount you enter in.

Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. Clean attractive and easy to use interface. For provinces that split GST from PST such as Manitoba British Columbia Quebec and Saskatchewan a No PST checkbox will appear.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Tax Me is accurate easy to use and helps you quickly calculate Canadian sales tax for any province or territory. - quickly and accurately calculate sales taxes GST PST HST QST and RST for all Canadian provinces and territories.

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. Amount without sales taxes x. This app is especially useful to all manner of professionals who remit taxes to government agencies.

An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Tax reverse calculation formula. Tax Me is accurate easy to use and helps you quickly calculate Canadian sales tax for any province or territory.

The following table provides the GST and HST provincial rates since July 1 2010. Amount without sales tax GST rate GST amount. The period reference is from january 1st 2021 to december 31 2021.

Calculate the total income taxes of the British Columbia residents for 2021. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. To calculate the total amount and sales taxes from a subtotal.

Sales taxes make up a significant portion of BCs budget. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses. As well as entrepreneurs and anyone else who may need to figure out just how.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and. GSTHST provincial rates table.

Amount without sales tax QST rate QST amount. Use this online tool whenever you need to check the amount of the items youve purchased before the added sales tax. Do you like Calcul Conversion.

That entry would be 0775 for the percentage. Type of supply learn about what supplies are taxable or not. - conveniently perform mathematical calculations via an in-app math calculator.

How to use the reverse sales tax calculator. Overview of sales tax in Canada. Ensure that the Find Invoice Total tab is selected.

To use the sales tax calculator follow these steps. There are two options for you to input when using this online calculator. Here is how the total is calculated before sales tax.

Calculates the canada reverse sales taxes HST GST and PST. The rate you will charge depends on different factors see. Including the net tax income after tax and the percentage of tax.

Canadian Sales Tax Calculator helps you to. Click to select it if the seller is in a different. Now I want to calculate the tax from the total cost.

Great for finding your total cost before a purchase.

Avalara Tax Changes 2022 Read This Now Thank Us Later

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Hst Calculator Hstcalculator Ca

How To Calculate Sales Tax Backwards From Total

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Canada Sales Tax Calculator By Tardent Apps Inc

Canada Sales Tax Gst Hst Calculator Wowa Ca

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Canada Sales Tax Calculator By Tardent Apps Inc

Saskatchewan Gst Calculator Gstcalculator Ca

How To Calculate Sales Tax Backwards From Total

Avalara Tax Changes 2022 Read This Now Thank Us Later

Canada Sales Tax Calculator By Tardent Apps Inc

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price